If you’re looking for a hot, fast growing, and in-demand job, then you should consider a career in Finance. According to the U.S. News, becoming a Financial Manager post-MBA is one of the smartest decisions you can make. The projected growth rate is 30 percent between 2014-2024, and it’s ranked as the #4 Best Business Job.

As for MBAs, more than 8 in 10 (84 percent) of finance and accounting firms plan to hire MBA graduates in 2016, and 24 percent of all alumni obtained a job in finance/accounting—making it the most sought-after job field.

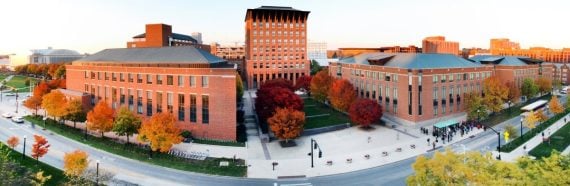

One of the reasons a career in finance is so attractive post-MBA is because most MBA programs offer a concentration in Finance. The Booth School of Business, Rutgers Business School, and the Kellstadt Graduate School of Business all offer Finance MBAs. These concentrated programs provide students with competence and a broad set of skills for a career in the industry.

For those looking to enter the finance industry, the most common post-MBA jobs are financial analyst, financial advisor, and financial manager. To help you decide if these are the right jobs for you, we’re breaking it down.

Financial Manager Job Description

Financial managers are responsible for the financial health of an organization. According to the Bureau of Labor Statistics, financial managers have three primary roles: to prepare and produce financial reports, to direct investment activities, and to develop strategies and plans for long-term financial goals.

To be a financial manager, there are ten qualities necessary for success.

- Integrity: When you work in finance, a commitment to ethics is key.

- Fearlessness: Financial managers have to be able to make difficult and sometimes risky decisions that can impact the bottom line.

- Tech & Finance Intelligence: You should be able to work with sophisticated systems and applications to improve your company’s financial data and efficiency.

- Multi-tasker: Financial managers are pulled in many directions and have to wear many hats.

- Inspirational: It’s important to be able to bring out the best in your team.

- Embraces Change: Change is constant in every company, and financial managers need to be flexible enough to survive and embrace each change.

- Visionary: You have to be able to look at the future with a strategic mindset, taking account of trends and their impact on your company.

- Good Communicator: Financial managers participate in critical business discussions, negotiations, and presentations.

- Accessible: An open door policy where a Financial Manager is available to his/her employees and coworkers is critical.

- Skilled Interpersonally: Financial managers collaborate with a broad range of individuals within every organization.

Financial Manager Salary

The average financial manager makes $117,990 per year or $56.73 per hour. Financial managers with an MBA can expect to earn in the 75th percentile—around $159,230 a year. On the other hand, financial analysts earn approximately $92,250 while financial advisors earn $108,090. If you want to earn the highest pay as a financial manager, consider working in New York City, San Francisco, or San Jose, California.

MBA Curriculum for Financial Managers

MBAs in Financial Management offer advanced course topics unique to a career in finance. At the Booth School of Business, there are multiple classes that Finance MBAs will need to take for their degree. A few of those courses include:

- Financial Instruments: This course helps students develop, assess, and apply theories of pricing derivatives.

- Portfolio Management: This is a quantitative course focused on advanced material relevant to portfolio managers.

- Financial Markets & Institutions: This course is dedicated to corporate finance and studies financial institutions, financial crises, and financial contracts.

- Advanced Investments: This course reviews pricing over the last 20 years and covers topics such as stocks and bonds, value, growth, and momentum effects, and return predictability.

Do You Need an MBA?

We recently wrote an article comparing and MBA in Finance and a Master’s in Finance. In that article, we revealed the importance of earning an advanced degree for a career in Finance and the flexibility, in particular, which an MBA provides.

MBAs have a wider range of choices for their career post-graduation. They can seek a variety of different positions within the finance field and outside of the field.

“The MBA, particularly those from elite schools, offer something else—exit options,” revealed eFinancialCareers. “A lot of people take MBAs with the aim of advancing their finance career, but end up moving into another sector entirely, particularly if they attend an elite school where a range of employers swoop on MBA candidates during various networking and recruitment events. An MBA offers that unrivaled diversity of career options.”

This post has been republished in its entirety from its original source, metromba.com.